Ouille! 15+ Vérités sur Letter Of Explanation Of Derogatory Credit? Frequently asked questions about credit scores.

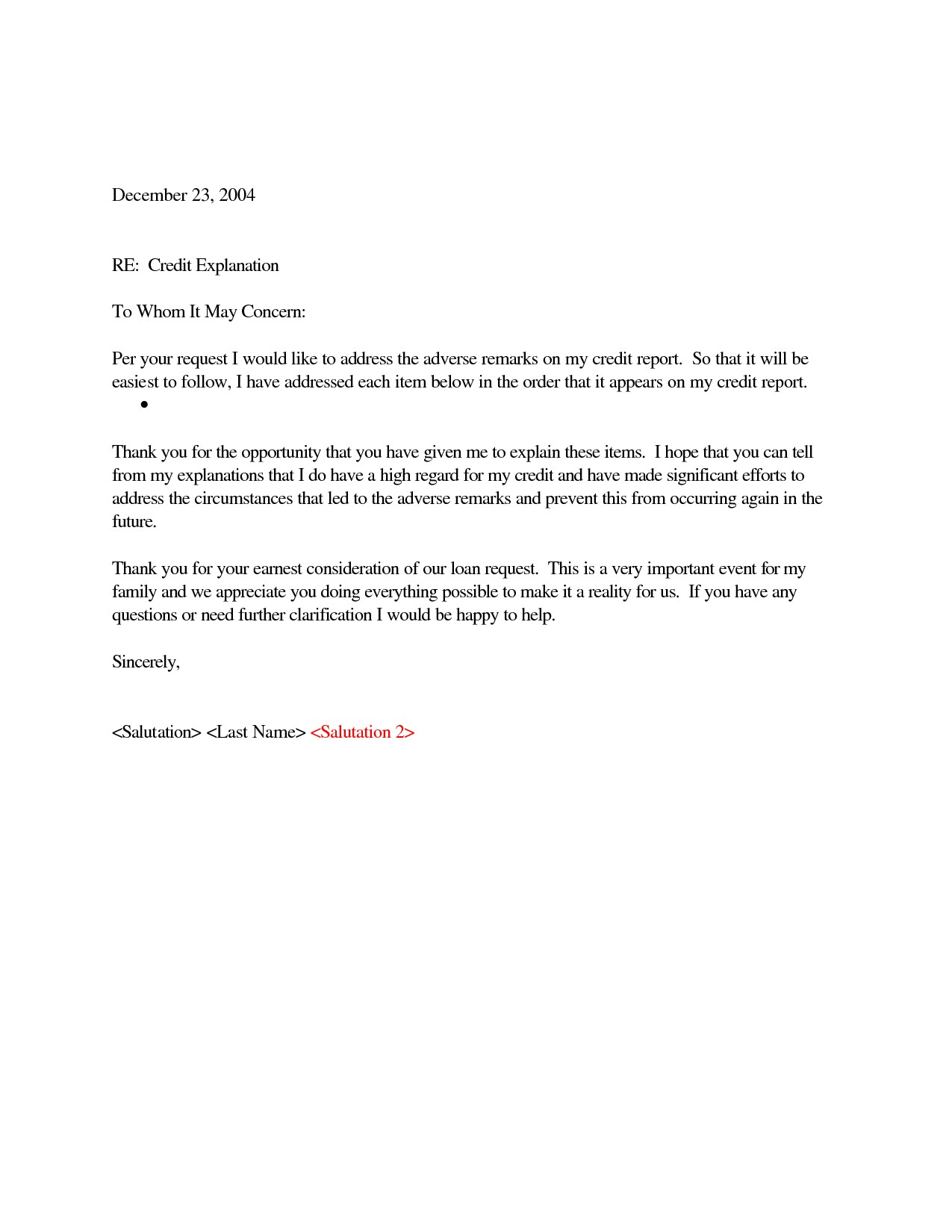

Letter Of Explanation Of Derogatory Credit | Derogatory items on your credit report. The federal housing administration (for you may need to provide a letter of explanation for any negative items on your credit report, including missed payments, defaulted loans or repossessions. Learn about common negative marks, how long they last and how to improve your credit. 35+ sample letter of explanation templateswhat is a letter of explanation?reasons why you need to create a letter of the following are reasons why a borrower must provide an explanation letter to his lender: A good credit explanation should contain the following: If you have a derogatory but accurate record, do your best to work around it. There are many different letters of credit including one called a revolving letter of credit. Derogatory marks on your credit are negative items such as missed payments, collections, repossession and foreclosure. However, some are more severe and can last as long as ten years from the time of the account's last activity. 8 how to write a good letter of explanation? _explanation of (please to the best of your ability; Lenders must know if you have difficulty handling your finances. Add a letter of explanation to your credit file if you feel extenuating circumstances. Writing a good bankruptcy explanation letter, and providing supporting documentation, will make it easier for the lender to approve your application. Multiple derogatory items will also cause your credit score to drop. Send your letter by certified mail, return receipt requested, so you can document that the. Letters of explanation are requirements from secondary authorities that own or back the loan in many cases. Letters of explanation will be required for the following items: However, the mortgage lender can still request a letter of explanation for any derogatory information appearing on your credit report, regardless of. An acknowledgement of what happened. Explanation of public records (please indicate how you received these: We know that credit letter is an official. Most derogatory marks stay on your credit report for seven years. Multiple derogatory items will also cause your credit score to drop. A good credit explanation should contain the following: A derogatory mark can land on your credit reports in two ways. It is important to produce the accurate document in order to make your credit application eligible for the bank approval. Letters of explanation will be required for the following items: It's crucial to understand the different types of derogatory items so you know how you can avoid adding any new ones to your. This demonstrates honesty and understanding of make sure that your borrower's credit explanation letter corresponds with the credit report. Lenders must know if you have difficulty handling your finances. The word derogatory simply means negative, so a derogatory credit item is a negative item on your credit report. A letter of explanation is your opportunity to explain to the lender in detail why there are negative marks on your credit. Many of your creditors report your credit limit, current account balance and payment history directly to the three credit reporting agencies. A letter of explanation for derogatory items on a credit report should explain the circumstances that caused any late payments and why future late payments will not occur, according to guston cho associates. Most loan officers still simply give the borrower a list of derogatory accounts and ask them to explain them. In order for us to better understand your situation, please provide us in your own handwriting, answers to the following questions. A good letter of explanation should be truthful, clear, and detailed. Borrower letter of derogatory credit. Letters of credit are often used within the international trade industry. A letter of credit is a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount. Letters of credit are often used within the international trade industry. Many derogatory marks linger on your credit report for seven years. A letter of explanation is a short document you would send to a recipient such as a lender. A creditor or lender may report negative information to the credit bureaus, which is the amount of time a derogatory mark stays on your credit reports depends on what type of mark it is. Letters of explanation are requirements from secondary authorities that own or back the loan in many cases. Derogatory credit explanation letter note: A letter of explanation for derogatory items on a credit report should explain the circumstances that caused any late payments and why future late payments will not occur, according to guston cho associates. Lenders must know if you have difficulty handling your finances. A letter of explanation is a short document you would send to a recipient such as a lender. Sample of a credit letter of explanation. Most loan officers still simply give the borrower a list of derogatory accounts and ask them to explain them. Learn about common negative marks, how long they last and how to improve your credit. How to deal with derogatory public records. Borrower letter of derogatory credit. Many derogatory marks linger on your credit report for seven years. Multiple derogatory items will also cause your credit score to drop. The federal housing administration (for you may need to provide a letter of explanation for any negative items on your credit report, including missed payments, defaulted loans or repossessions. Letters of explanation will be required for the following items:

Letter Of Explanation Of Derogatory Credit: A letter of explanation for derogatory items on a credit report should explain the circumstances that caused any late payments and why future late payments will not occur, according to guston cho associates.

Refference: Letter Of Explanation Of Derogatory Credit

0 Comment